| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBGI | 16.69 | 12.54 | 302.1687% |

| SRV^ | 0.1171 | 0.0746 | 175.5294% |

| LUCYW | 0.0778 | 0.0376 | 93.5323% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| LVROW | 0.0184 | 0.0081 | 78.6408% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WOK | 0.19 | -5.38 | -96.5889% |

| ATPC | 0.068 | -1.252 | -94.8485% |

| POM | 0.5 | -4.92 | -90.7749% |

| CHOW | 1.84 | -9.86 | -84.2735% |

| AFJKU | 33.0 | -52.6 | -61.4486% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SOXS | 2.825 | -0.105 | -3.5836% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| PAVS | 0.0381 | -0.0051 | -11.8056% |

| NVDA | 183.78 | -1.19 | -0.6433% |

| MNTS | 0.8904 | 0.1264 | 16.5445% |

Opinion News

Amtech Systems Inc. (ASYS) has released its annual Form 10-K report, revealing a challenging financial year with decreased revenue and significant net losses. The company is focusing on strategic initiatives like R&D, a semi-fabless manufacturing model, and real estate asset sales to navigate the highly cyclical semiconductor industry. Despite challenges, Amtech anticipates future growth driven by AI infrastructure, supply chain resiliency, and advanced mobility markets.

Seagate Technology's stock has reached an all-time high of $298.0 USD, reflecting a significant 202.49% increase over the past year and strong investor confidence. This milestone follows strategic financial moves, including a $500 million note exchange, and positive analyst upgrades based on improved supply-demand dynamics in the hard disk drive industry. Analysts from BofA Securities, TD Cowen, and Cantor Fitzgerald have raised price targets, anticipating continued growth for Seagate.

Wolfspeed (NYSE:WOLF) shares dropped 5.8% on Wednesday to $21.4450 on an 84% decline in trading volume, despite the company slightly beating quarterly revenue and EPS estimates. Analysts are mixed with a "Reduce" consensus rating and a $10.50 average price target, expecting significant full-year losses. Institutional investors have notably adjusted their stakes, with Vanguard increasing its holdings.

Keysight Technologies Inc. (NYSE:KEYS) stock has hit an all-time high of $212.98 USD after a 24.61% increase over the past year and a 31.02% YTD return, driven by strong financial results and strategic initiatives. Despite trading at a high P/E ratio, analysts from UBS, Wells Fargo, Jefferies, and Baird have increased price targets due to robust performance, especially in AI and data center demand. InvestingPro suggests the stock might be overvalued, with RSI indicating overbought conditions.

Backblaze, Inc. will present at the Gartner IT Infrastructure, Operations, & Cloud Strategies Conference 2025, with Patrick Thomas, Head of GTM, outlining how an independent data layer can solve data sprawl and foster AI agility. The presentation will offer a strategic playbook for I&O leaders to overcome data fragmentation and vendor lock-in by adopting a vendor-neutral, S3-compatible data layer. Backblaze aims to equip organizations with a flexible foundation optimized for AI and multi-cloud initiatives, showcasing real-world examples of substantial cost reductions and improved performance.

Lam Research stock reached an all-time high of $167.29, reflecting a 123.4% increase over the past year and strong investor confidence. The company demonstrates robust fundamentals with a P/E ratio of 36.36 and 25.66% revenue growth, maintaining a "GREAT" financial health score. Analysts have raised price targets, citing strong demand and growth opportunities in the wafer fabrication equipment sector.

Intuit's growth is attributed to its asset-light localization strategy, high customer retention, and the successful integration of Credit Karma. This growth occurs as Director Richard L. Dalzell has initiated a plan to sell 999 shares of restricted stock.

T-Mobile US CEO Srini Gopalan has declared the company's ambition to lead the industry in 6G development, building on its 5G successes. He emphasized the critical role of AI in 6G, particularly for operational efficiencies and enabling new applications like advanced automation and robotics that require low-latency "physical AI" capabilities. Gopalan also highlighted anticipated improvements in spectrum efficiency and cybersecurity through 6G, acknowledging the early stages of global standardization efforts.

Western Digital (WDC) stock achieved an all-time high of $178.51, reflecting significant investor confidence and strong market performance with a 227.28% increase over the past year. Analyst firms like BofA Securities, TD Cowen, UBS, and Baird have raised their price targets, signaling a positive outlook for the company driven by strategic advancements and favorable market conditions. The company's financial health is rated as "GREAT" by InvestingPro, indicating potential for continued growth.

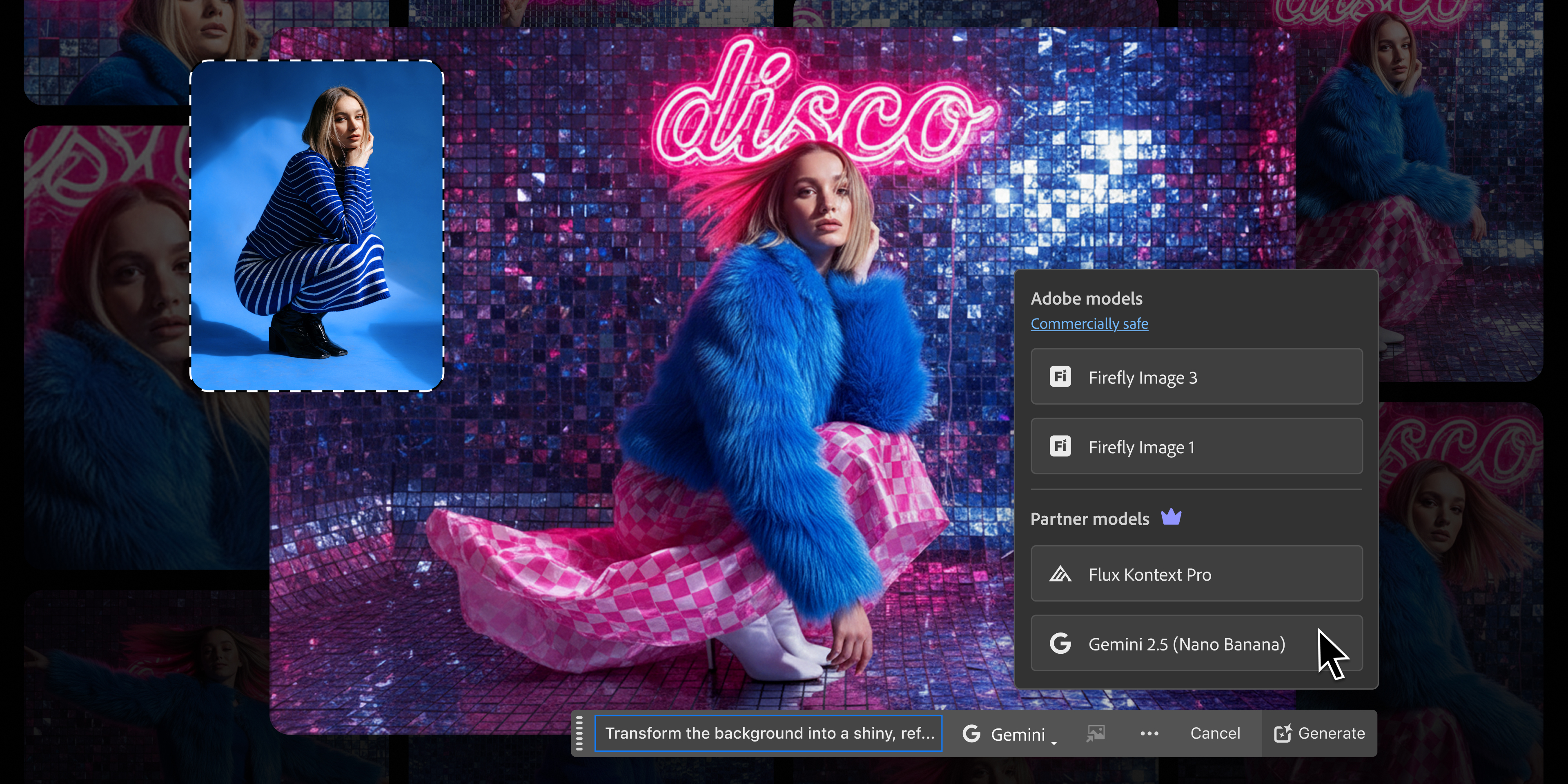

Adobe Inc. reported stronger-than-expected earnings and revenue for its fiscal 2025 fourth quarter, driven by its AI-driven tools and significant subscription revenue growth. The company also provided an optimistic forecast that exceeded analyst expectations for the upcoming fiscal year. Key business highlights included product updates with new AI features and the launch of Adobe AI Foundry and AI agents for marketers.

The west must not prevaricate when it comes to seizing Russian reserves

Ruchir Sharma