| Symbol | Price | Change | %Change |

|---|---|---|---|

| ILLRW | 0.069 | 0.0444 | 180.4878% |

| ATPC | 0.1799 | 0.1119 | 164.5588% |

| CINGW | 0.085 | 0.0479 | 129.1105% |

| PL+ | 6.99 | 3.0 | 75.188% |

| GIBOW | 0.0374 | 0.0154 | 70.0% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OCG | 0.911 | -7.789 | -89.5287% |

| RZLT | 1.4 | -9.54 | -87.2029% |

| CISS | 0.33 | -1.39 | -80.814% |

| YGMZ | 0.0216 | -0.0346 | -61.5658% |

| GRI | 0.5269 | -0.6831 | -56.4545% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ATPC | 0.1799 | 0.1119 | 164.5588% |

| SOXS | 2.875 | 0.055 | 1.9504% |

| NVDA | 180.93 | -2.85 | -1.5508% |

| WOK | 0.1681 | -0.0219 | -11.5263% |

| BEAT | 2.12 | 0.57 | 36.7742% |

Mining & Explorations News

SoundThinking, Inc. (SSTI) has scheduled a virtual meeting for December 18, organized by Lake Street, to discuss its future prospects and strategies with investors. The company operates in public safety technology, focusing on solutions like ShotSpotter, and despite challenges in profitability, maintains a strong market presence. The meeting is an opportunity for investors to gain insights into SoundThinking's direction, especially given its mixed financial health and potential liquidity constraints.

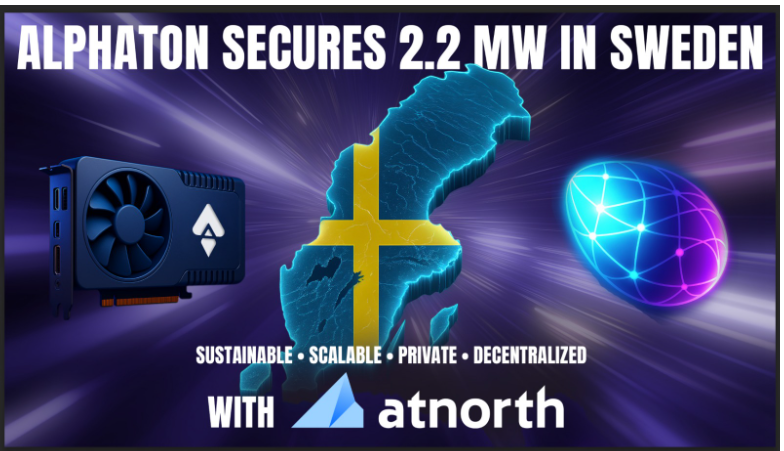

AlphaTON Capital (NASDAQ: ATON) has signed a 60-month agreement with atNorth for 2.2 MW of high-performance computing capacity at a Tier 3 facility in Kista, Sweden, starting February 1, 2026. This deal includes a Right of First Refusal for an additional 2.1 MW, potentially bringing their total capacity to 4.3 MW, capable of deploying over 4,000 GPUs. The infrastructure will support AI-as-a-Service, GPU compute marketplaces, and inference services for the Telegram ecosystem.

Katherine S. Ngai-Pesic, a director and 10% owner at Silvaco Group, Inc. (NASDAQ:SVCO), purchased 25,000 shares of common stock for $103,305 on December 10, 2025. This transaction increased her direct holdings to 10,303,886 shares. The acquisition follows Silvaco's reported record Q3 2025 revenue, a restructuring plan, and analyst ratings, with Rosenblatt lowering its price target to $9.00 while Needham reiterated a Buy rating at $10.00.

Retail investors are actively buying shares of Netflix (NFLX) following a $40 billion market value decline triggered by skepticism around its potential acquisition of Warner Bros. Discovery. Despite a 15% drop over six sessions, representing its worst losing streak since May 2022, amateur investors perceive this downturn as a significant buying opportunity. Netflix was notably the third most active stock on Interactive Brokers' platform for the week ending Monday, indicating strong retail interest amidst Wall Street's concerns over a potential bidding war.

Raymond James is aggressively pursuing artificial intelligence (AI) to gain a competitive edge, emphasizing its potential as a "huge differentiator" with full advisor buy-in. The firm has launched AI products, embedded machine learning tools, and appointed dedicated executives for AI initiatives. They have committed nearly $1 billion of their annual budget to technology, highlighting their significant investment in this area.

Halliburton and VoltaGrid have announced a collaboration to deliver 400 megawatts of modular natural gas power systems for data centers in the Eastern Hemisphere, with delivery expected by 2028. This partnership combines Halliburton's operational expertise with VoltaGrid's distributed power platform to provide lower-emission power solutions for hyperscale data centers supporting AI, cloud computing, and digital transformation. Halliburton, undervalued according to InvestingPro analysis, sees this as a significant investment to meet the unprecedented power demands of digital infrastructure growth.

Azio AI, a Supermicro distributor, is engaged in early-stage talks with the Philippines to support the modernization of its Maharlika Investment Fund and corporation. This involves evaluating GPU-based AI data centers and sovereign compute architectures as part of the country's 2024–2025 planning cycle. The initiative aligns with Azio AI's strategy to expand into sovereign and public-sector AI infrastructure, although any commercial engagement is subject to definitive agreements.

SailPoint (SAIL) has seen its shares rebound by about 6% recently, despite being down year-to-date and trading significantly below analyst targets, prompting a re-evaluation of its valuation. The company's price-to-sales ratio of 11.6x is more than double the industry average, indicating a premium valuation for future revenue growth over near-term profitability, especially as it remains loss-making. A Discounted Cash Flow model suggests a fair value of $11.70 per share, significantly below the current $21.02, hinting at potential overvaluation.

Amazon has significantly expanded its same-day grocery delivery service for Prime members, now reaching over 2,300 cities, up from 1,000 cities in August. The retailer has also increased its grocery selection by 30% and plans further expansion in 2026. Prime members receive free same-day delivery on orders over $25.

AlphaTON Capital (ATON) has secured a significant colocation agreement with atNorth AB, a European data center operator, to enhance its infrastructure for decentralized AI computing. Operating in digital asset management within the financial services sector, AlphaTON faces challenges including zero revenue and negative earnings, reflected in its low GF Score of 41. This strategic alliance is a key step, though investors should consider the financial risks and high volatility.

The west must not prevaricate when it comes to seizing Russian reserves

Ruchir Sharma