| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBGI | 16.69 | 12.54 | 302.1687% |

| SRV^ | 0.1171 | 0.0746 | 175.5294% |

| LUCYW | 0.0778 | 0.0376 | 93.5323% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| LVROW | 0.0184 | 0.0081 | 78.6408% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WOK | 0.19 | -5.38 | -96.5889% |

| ATPC | 0.068 | -1.252 | -94.8485% |

| POM | 0.5 | -4.92 | -90.7749% |

| CHOW | 1.84 | -9.86 | -84.2735% |

| AFJKU | 33.0 | -52.6 | -61.4486% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SOXS | 2.825 | -0.105 | -3.5836% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| PAVS | 0.0381 | -0.0051 | -11.8056% |

| NVDA | 183.78 | -1.19 | -0.6433% |

| MNTS | 0.8904 | 0.1264 | 16.5445% |

Finance News

Putnam Greene Financial Corporation has selected Jack Henry to modernize and standardize the technology infrastructure across its four subsidiary banks. The choice was driven by Jack Henry's modern core processing platform, which offers scalability, flexibility, and strong integration capabilities. This move aims to enhance digital experiences and solidify the holding company's technological landscape.

Corning Inc. stock reached a 52-week high of $92.6 USD, climbing further to $92.83, reflecting strong investor confidence and a 93.87% appreciation over the past year. Despite trading above its Fair Value according to InvestingPro, analysts project further upside with a top price target of $109, driven by anticipation of their next earnings report on February 3, 2026. The company also reported strong Q3 2025 financial results and UBS raised its price target due to expected growth in Corning’s optical segment from data center expansion.

Intuit's growth is attributed to its asset-light localization strategy, high customer retention, and the successful integration of Credit Karma. This growth occurs as Director Richard L. Dalzell has initiated a plan to sell 999 shares of restricted stock.

Western Digital (WDC) stock achieved an all-time high of $178.51, reflecting significant investor confidence and strong market performance with a 227.28% increase over the past year. Analyst firms like BofA Securities, TD Cowen, UBS, and Baird have raised their price targets, signaling a positive outlook for the company driven by strategic advancements and favorable market conditions. The company's financial health is rated as "GREAT" by InvestingPro, indicating potential for continued growth.

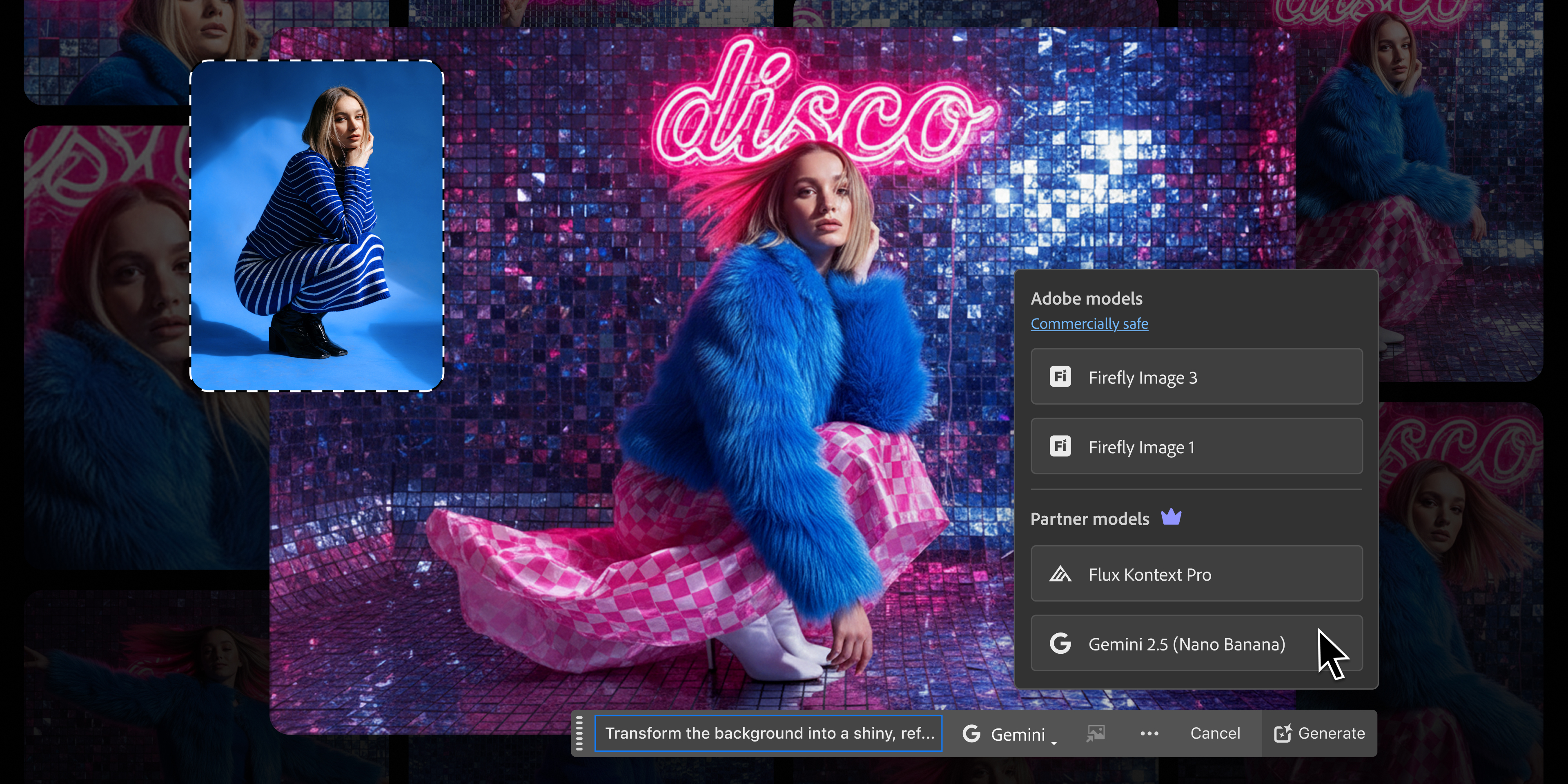

Adobe Inc. reported stronger-than-expected earnings and revenue for its fiscal 2025 fourth quarter, driven by its AI-driven tools and significant subscription revenue growth. The company also provided an optimistic forecast that exceeded analyst expectations for the upcoming fiscal year. Key business highlights included product updates with new AI features and the launch of Adobe AI Foundry and AI agents for marketers.

Bank of New York Mellon's stock reached an all-time high of $117.42, reflecting strong investor confidence with impressive 1-year and year-to-date returns. The company, which has a "GOOD" financial health rating and a 55-year history of dividend payments, is considered undervalued by InvestingPro analysis. Recent developments include a raised price target from TD Cowen, integration of Google Cloud AI, launch of a stablecoin reserves fund, and a decrease in its Prime Lending Rate.

Applied Materials Inc. (AMAT) stock has hit an all-time high of $273.63 USD, boasting a $216 billion market capitalization and a 60.44% one-year return. Despite a premium P/E ratio of 31.4 and appearing slightly overvalued by InvestingPro, the company's "GREAT" financial health and 21 consecutive years of dividend payments, along with recent analyst upgrades, highlight its strong performance in the semiconductor industry.

F5, Inc. presented at Barclays' 23rd Annual Global Technology Conference on December 10, 2025. The presentation included remarks from Timothy Long, IT Hardware, Comm Equipment analyst at Barclays, highlighting F5's participation in the event. The full transcript of this presentation is reserved for subscribers.

Wells Fargo's CEO announced that the bank anticipates further job reductions as it increases its adoption of artificial intelligence. The CEO believes this expansion of AI will enhance bank efficiency, though the local impact on Wells Fargo's largest employee base in Charlotte, which has approximately 27,000 workers, remains unaddressed by officials. The move comes amidst a lawsuit against the bank by former CEO Tim Sloan over stock awards.

T-Mobile has been referred to the Federal Trade Commission and state Attorneys General by the National Advertising Division (NAD) after the company declined to participate in an inquiry regarding its 5G network capacity claims. The inquiry was initiated following a challenge from AT&T, which argued that T-Mobile's assertions of superior 5G capacity lacked substantiation. T-Mobile cited an ongoing federal lawsuit filed by AT&T against BBB National Programs as its reason for non-participation, leading NAD to escalate the matter to regulatory authorities for potential enforcement action.

The west must not prevaricate when it comes to seizing Russian reserves

Ruchir Sharma