| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBGI | 16.69 | 12.54 | 302.1687% |

| SRV^ | 0.1171 | 0.0746 | 175.5294% |

| LUCYW | 0.0778 | 0.0376 | 93.5323% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| LVROW | 0.0184 | 0.0081 | 78.6408% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WOK | 0.19 | -5.38 | -96.5889% |

| ATPC | 0.068 | -1.252 | -94.8485% |

| POM | 0.5 | -4.92 | -90.7749% |

| CHOW | 1.84 | -9.86 | -84.2735% |

| AFJKU | 33.0 | -52.6 | -61.4486% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SOXS | 2.825 | -0.105 | -3.5836% |

| BEAT | 1.55 | 0.7445 | 92.4271% |

| PAVS | 0.0381 | -0.0051 | -11.8056% |

| NVDA | 183.78 | -1.19 | -0.6433% |

| MNTS | 0.8904 | 0.1264 | 16.5445% |

Automative News

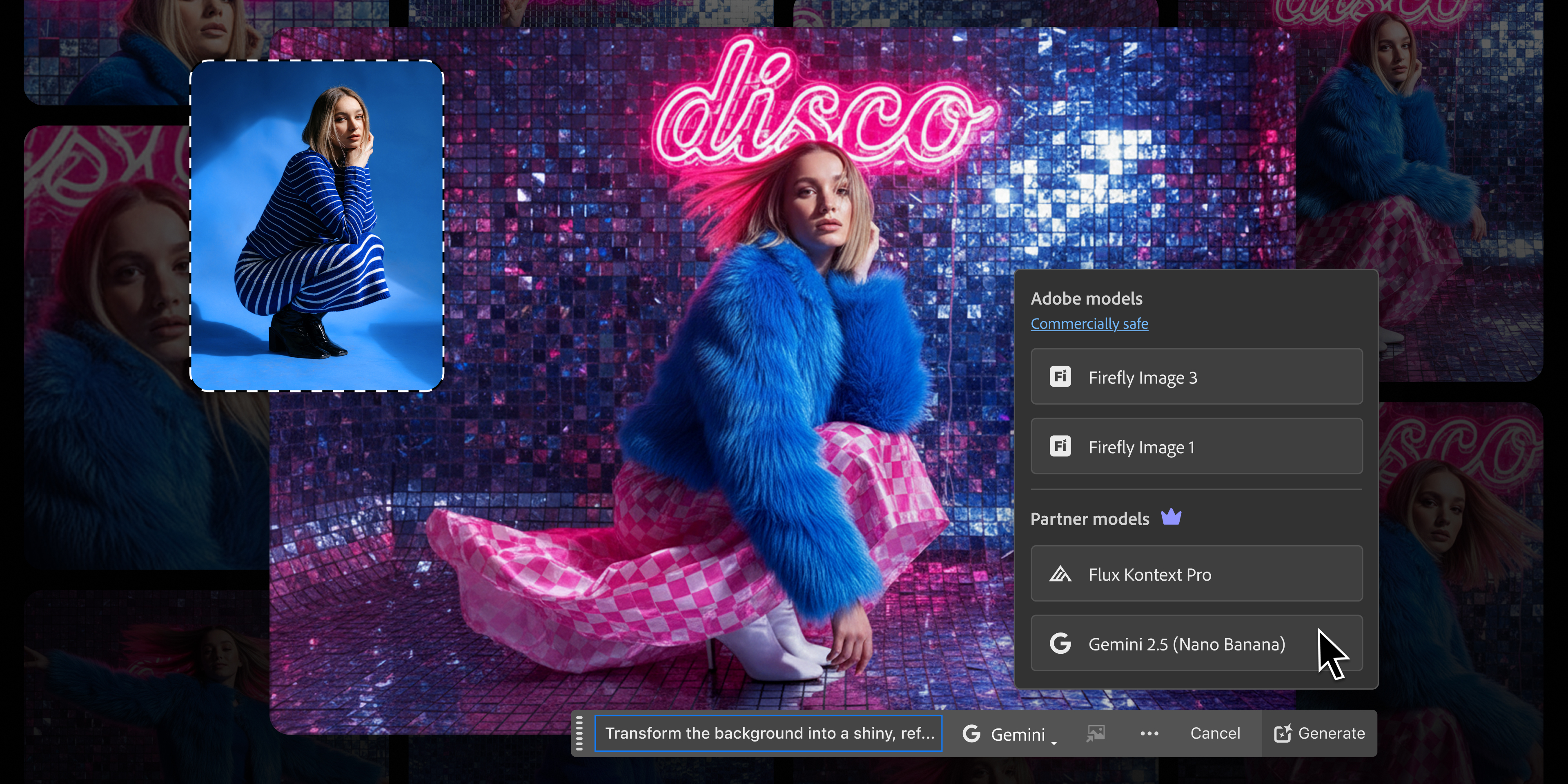

Adobe Inc. reported stronger-than-expected earnings and revenue for its fiscal 2025 fourth quarter, driven by its AI-driven tools and significant subscription revenue growth. The company also provided an optimistic forecast that exceeded analyst expectations for the upcoming fiscal year. Key business highlights included product updates with new AI features and the launch of Adobe AI Foundry and AI agents for marketers.

Seagate Technology Holdings PLC (STX) saw its stock price rally by 5.68% on a strong trading day, outperforming the S&P 500 Index and the Dow Jones Industrial Average. The company's stock hit a new 52-week high of $298.92, surpassing its previous peak. This performance occurred during a positive overall market session.

Stratasys has made its RadioMatrix radiopaque 3D printing material fully available across the United States. This material allows for the creation of patient-specific models with precise, tunable X-ray visibility, offering a repeatable and scalable alternative to cadavers for medical training and research. The material's capabilities have been validated through research with Siemens Healthineers, demonstrating high fidelity for CT phantoms.

Seagate Technology's stock has reached an all-time high of $298.0 USD, reflecting a significant 202.49% increase over the past year and strong investor confidence. This milestone follows strategic financial moves, including a $500 million note exchange, and positive analyst upgrades based on improved supply-demand dynamics in the hard disk drive industry. Analysts from BofA Securities, TD Cowen, and Cantor Fitzgerald have raised price targets, anticipating continued growth for Seagate.

Amtech Systems (ASYS) has announced a $5 million share repurchase program following strong financial results for Q4 2025, driven by demand for AI-related products. The company reported $19.8 million in net revenue and $1.4 million in non-GAAP net income, with AI infrastructure contributing over 30% to its Thermal Processing Solutions segment. Despite these positives, an analyst maintains a Hold rating with a $7.50 price target, citing ongoing operational inefficiencies and valuation concerns.

Backblaze, Inc. will present at the Gartner IT Infrastructure, Operations, & Cloud Strategies Conference 2025, with Patrick Thomas, Head of GTM, outlining how an independent data layer can solve data sprawl and foster AI agility. The presentation will offer a strategic playbook for I&O leaders to overcome data fragmentation and vendor lock-in by adopting a vendor-neutral, S3-compatible data layer. Backblaze aims to equip organizations with a flexible foundation optimized for AI and multi-cloud initiatives, showcasing real-world examples of substantial cost reductions and improved performance.

T-Mobile US CEO Srini Gopalan has declared the company's ambition to lead the industry in 6G development, building on its 5G successes. He emphasized the critical role of AI in 6G, particularly for operational efficiencies and enabling new applications like advanced automation and robotics that require low-latency "physical AI" capabilities. Gopalan also highlighted anticipated improvements in spectrum efficiency and cybersecurity through 6G, acknowledging the early stages of global standardization efforts.

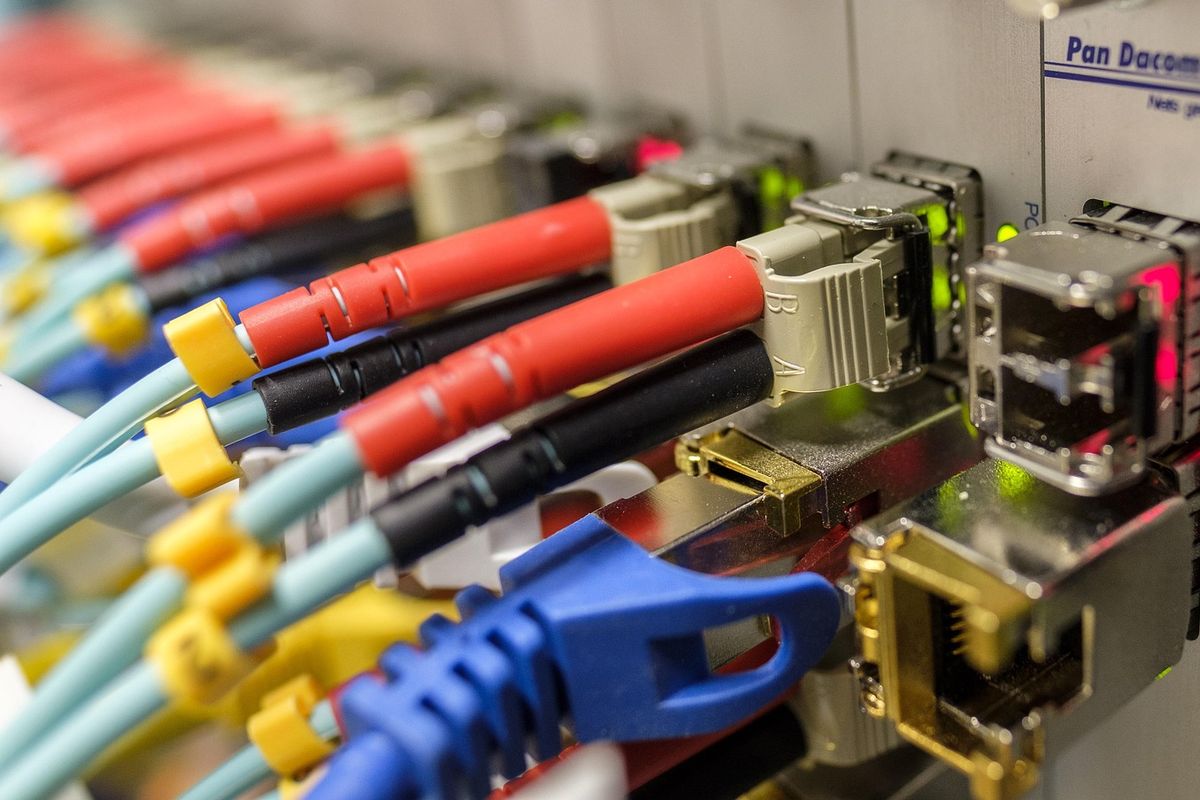

Putnam Greene Financial Corporation has selected Jack Henry to modernize and standardize the technology infrastructure across its four subsidiary banks. The choice was driven by Jack Henry's modern core processing platform, which offers scalability, flexibility, and strong integration capabilities. This move aims to enhance digital experiences and solidify the holding company's technological landscape.

A member of Commission VI DPR, Gde Sumarjaya Linggih, believes that PT Telkom Indonesia's (TLKM) spin-off of its fiber infrastructure business to InfraCo/TIF is a strategic move to address the digital divide and ensure equitable access to optimal services across Indonesia. This initiative is expected to boost efficiency in the telecommunications industry and foster a stronger digital ecosystem, potentially leading to broader infrastructure sharing. The digital economy is projected to be a significant contributor to the national economy, and this spin-off aims to act as a catalyst for its growth.

Microsoft Corporation (NASDAQ: MSFT) experienced a slight dip on December 10, 2025, closing down 2.7% and trading marginally lower after hours, primarily due to increased regulatory scrutiny on AI and concerns over monetizing its substantial AI investments. This comes as state attorneys general warned tech companies about "delusional outputs" from AI chatbots and Microsoft announced $23 billion in new AI data center investments. Despite these near-term pressures, Wall Street analysts maintain a broadly bullish outlook on Microsoft's long-term prospects, with price targets suggesting significant upside, though some quantitative models show mixed signals and long-term caution on valuation.

The west must not prevaricate when it comes to seizing Russian reserves

Ruchir Sharma